How to register as Tax Agency

In our short article ‘Tax Agent under UAE VAT’, we have discovered tax agents. Tax representatives are certified as well as certified persons who help taxable persons in their compliance tasks under VAT. Tax obligation representatives are signed up with the FTA and taxed persons can assign them to assist in satisfying their tax obligations.

A tax firm is a company of tax obligation representatives that sign up as an organization to aid taxpayers in their compliance activities. A tax agency will contain several tax agents. Keep in mind that all such tax obligation representative firms have to register as a tax obligation agency with the FTA in order to be accredited to assist taxpayers in conformity. This is an enhancement to the individual tax agent permit that the participants of the company may hold. In order to register as a tax company, the firm must have at the very least 1 tax representative linked to it.

Allow us to comprehend just how to register as a tax obligation company under UAE VAT.

What is a Tax Agency?

A tax firm is a legal entity which is accredited to operate as a tax obligation agency as well as has taken a tax obligation agency signed up with the FTA.

What are the problems for registering as a Tax Agency?

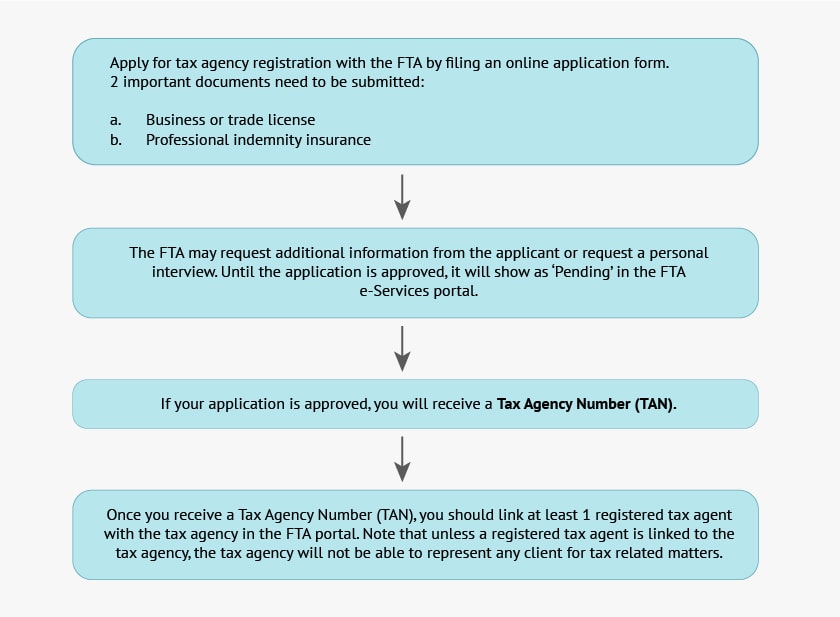

The problems to be satisfied with tax agency registration are:

a. Hold a company or trade license that enables the candidate to run as a tax obligation agency (normally provided by the Department of Economic Development), and

b. Have professional indemnity insurance policy in respect of the tax agency company

What is the process for making an application for registration as a tax obligation agency?

Process for obtaining registration as a tax obligation firm

Thus, every form of tax obligation agents needs to sign up as a tax obligation firm with the FTA in order to be able to help taxed persons in compliance tasks under VAT. A one-of-a-kind identification number (TAN) will be given to every signed up tax obligation agency under VAT. This overview on just how to end up being a tax obligation firm in UAE will certainly work to such individuals.