Common Enrolment Number for Registered Transporters

Since the GST e-way bill system originated, one of the usual demands from all signed up carriers has been, that they need to be allowed to make use of one registration number for upgrading e-way expenses throughout the nation. In other words, once the e-way costs are generated with one GSTIN coming from the company, the system ought to permit them to update Part B, making use of any one of their grins, without again updating the carrier number. To resolve this issue, the GST Council generated the necessary modifications. According to the latest adjustments, the carrier who is GST signed up in greater than one State or Union Territory with the very same Permanent Account Number might make an application for a unique usual enrolment number in the e-way expense system.

Exactly how to generate the typical enrolment number?

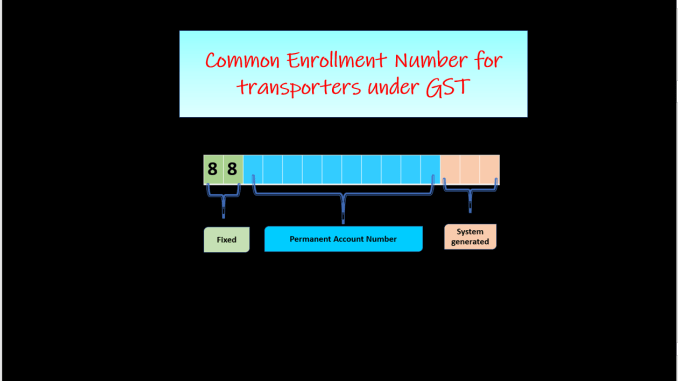

Upon recognition of the details provided in Form GST ENR02, the system will certainly generate a unique typical enrolment number and also will certainly show the exact same to the transporter. The common enrolment number, which will certainly be valid throughout the nation, is a 15-digit number starting with 88 complied with by the Permanent Account Number, while the last three figures are system generated.

Just how will this common enrolment number be utilized?

This common enrolment number will be utilized as a carrier number in the e-waybill system. When the carrier has actually acquired a distinct common enrolment number, he can not make use of any of his GSTINs for the functions of e-way costs generation or updating of carrier number in the e-way bills.

Likewise, the carrier requires to interact this number to his clients for updating as transporter number while producing e-way expenses. The e-way expense system will permit 10 days for accepting the old GSTINs and also ultimately these GSTINs will certainly be obstructed for the transporter number updation.

Usual Enrolment Number– Things to bear in mind

The following points need to be remembered when it comes to the common enrolment number–.

- All registered transporters, that have GSTINs in multiple states with the very same PAN, can utilize the common enrolment procedure readily available at the e-way expense portal.

- Once submission of demand with all GSTINs of the signed up carrier is done, the system will certainly generate the typical enrolment number, starting with 88 for this function.

- This common enrolment number can be made use of by the transporter for updating Part B from any of his branches throughout the nation, without additional transforming the carrier number.

- For the common enrolment number, the transporter can develop numerous login accounts and also share the exact same to his branches throughout the nation for simple operation of Part B in the e-way costs.

- This enrolment number should be made use of to produce the e-way expenses and upgrading of the Part-B and the registered carrier numbers, which are GSTINs, will not be allowed for the generation of e-way costs.

- This enrolment number must be connected by the transporter to his clients to update this number as carrier number while creating e-way bills.